Petrobras hits gross debt target more than a year ahead of schedule

The recurring adjusted EBITDA of $12.2 billion and strong operating cash generation of $10.5 billion are also highlights of the third quarter financial result

Petrobras decreased its gross debt, in the third quarter of 2021, to the amount of US$ 59.6 billion. With the result, the company reaches, more than a year ahead of schedule, the target of US$ 60 billion, scheduled for the end of 2022.

“The accomplishment of this target, before the agreed-upon deadline, shows the company’s commitment to a technical and balanced management. Petrobras’ debt reached more than US$ 130 billion in 2014, a figure that was around US$ 160 billion, if we also consider the charters that were accounted as debt from 2019 on with the adoption of IFRS 16. For many, this debt seemed unpayable, and today it is finally reaching a healthier level. Everyone who is part of this company has contributed to this and is responsible for the reduction of over US$ 100 billion in little more than seven years”, says Rodrigo Araujo, Chief Financial and Investor Relations Officer.

In the financial result of the third quarter 2021, Petrobras had a recurring net profit of US$ 3.3 billion. Among the highlights are the generation of operating cash and free cash flow, totaling US$ 10.5 billion and US$ 9 billion, respectively, and recurring adjusted EBITDA of US$ 12.2 billion.

Other highlights of the result are the receipt of US$ 2.9 billion from the partners in the Buzios co-participation agreement and the cash inflow of US$ 2.2 billion from the public offering of Petrobras Distribuidora, held in July.

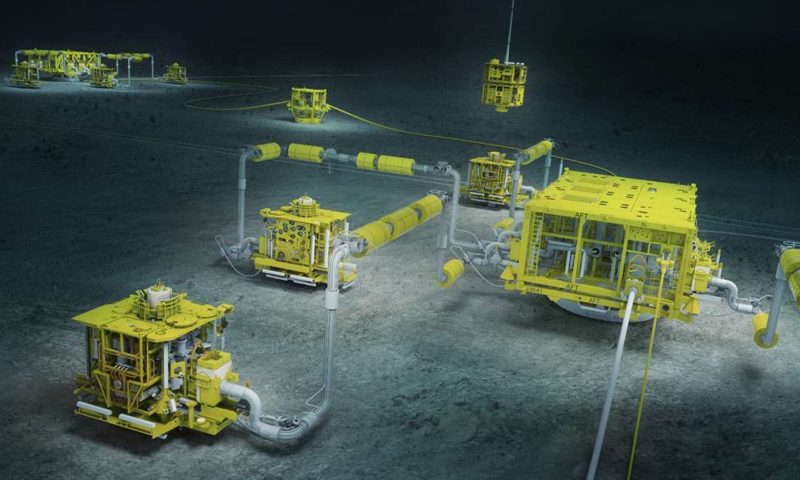

The quarter’s solid financial performance was the result of the good operational performance. Petrobras’ average production of oil, natural gas liquids (NGL), and natural gas reached 2.83 million barrels of oil equivalent per day (boed) in the period, a 1.2% increase compared to the previous quarter, even with the COVID-19 pandemic restrictions. The pre-salt reached 71% production, with the highlight being the FPSO Carioca (Sepia field) coming into operation and FPSO P-70 (Atapu field) reaching peak production.

Oil products sales in the quarter reached volumes of 1.9 million barrels per day (bpd), 10.7% more than in the previous quarter, with an increase in the commercialization of all products. Oil product production at the refineries also rose 11% in the same period due to the higher demand from the domestic market and greater availability of the refining units. When comparing the second and third quarters, the refinery utilization factor increased from 75% to 85%, and, in October, it reached 90%.

On October 5, Petrobras successfully concluded the programmed shutdown of Route 1 in the Santos Basin pre-salt. Several actions have been taken to mitigate the impacts associated with the reduction in gas supply, such as the expansion of the Guanabara Bay Regasification Terminal’s capacity from 20 million to 30 million cubic meters per day and the increase in the volume of regasified LNG, which reached an average of 30 million cubic meters per day in the third quarter, a 66.7% growth compared to the previous quarter.

Petrobras continues to make every effort to maximize the gas supply. As a result, in the third quarter, power generation was 3,977 average MW, a 20.6% increase over the previous quarter.

“We will continue to act with capital discipline, investing in resilient assets with adequate rates of return, focused on generating value for society. The result of this work is profit, but it is good to emphasize that Petrobras does not pursue profit for its own sake. Our goal is to return value to our shareholders and to society, through taxes, dividends, job generation, and investments, which within the context of the energy transition, should be accelerated, especially the pre-salt development,” highlights Joaquim Silva e Luna.